Creating a Sustainable Budget 101

What is a budget and why should everyone have one in place? And how can you come up with a plan for a budget that is sustainable over the time period you need one for.

Let’s start with the question what a budget is. A budget is a management tool that anyone can use and implement either for a short or long time period. Say you want to save for a down payment on a mortgage. Then short-term budgeting will help you get to your goal amount. Or long-term budgeting for things such as your retirement.

Rebecca C Penner CPA, CGA https://rcpenner.com/contact

The following steps will help you create and maintain a sustainable budget.

1. The first step is to know your net income each month. You will need to sit down and identify the amount of income that you have coming in each month.

2. Create a spread sheet to track your monthly spending. For things like rent/mortgage, utilities, groceries and personal spending. Excel have some great templates to use to track your financial outgoings. This is also great for seeing where your money is being spent. For instance, if I asked you to tell me how much money you spend per month on coffee, most people will say “oh no not that much” until they start tracking each time, they buy a Starbucks or Tim Hortons.

3. Step 3 is to establish and set your financial goals. Why are you doing this in the first place. What is your goal amount? Make sure you are setting yourself up to succeed by setting a realistic and sustainable goal. Like I said before if your goal is short term, then put the date that you need your budget to end. If it’s a long-term goal, then the budget will be set to ongoing.

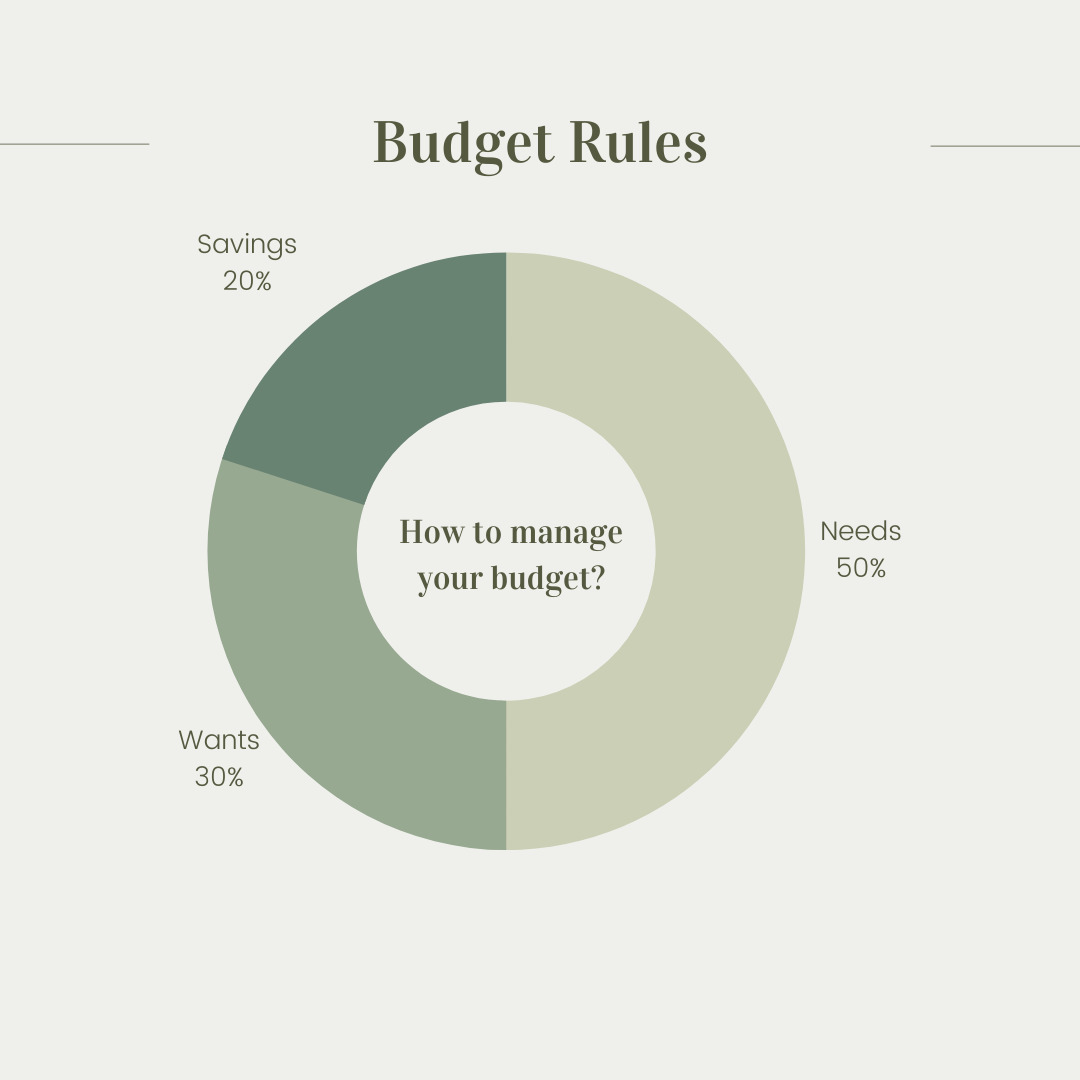

4. As in the picture above you will need to separate “Needs and Wants”. By this I mean to be able to reach your financial goal what do you need to pay out each month, oppose to what is it you want. The rent and utility bill are a need to pay. That Lois Vuitton purse is a want. So, what will you sacrifice to get to your goal?

Rebecca C Penner CPA, CGA https://rcpenner.com/contact

5. Once you have taken care of all the above steps you will need then to put your budget plan into action. Choose a date that you will start your budget and a date when you want to reach your budget goals.

6. Pick a day each week to check in and see where you are. Are you on track? Does your goal need adjusting? Did an unexpected purchase occur, and because of this you may need to reassess your goal end date?

To move forward with our lives and not struggle each month to pay our bills, we all should establish a budget. Everyone should know how much each month you will need just to live. This isn’t the amount spent on going to a restaurant or buying personal items. You will need a budget for these things also.

Living above our means is a very easy thing to do in our time. We are bombarded with credit card advertising and loans that are readily available to us. We can all get sucked into the fantasy of paying a large interest rate for the life we want to live but really can’t afford.

Financial assistance is readily available to advise you in your financial journey.

Thank you for reading my blog and if you need any assistance with finances please contact me.

As always thank you for taking the time to read my blog.

If you have any questions, please don’t hesitate to reach out.

Sincerely,

Rebecca C Penner CPA, CGA