Project Accounting: What is it and Does Your Company Need It

Project accounting is a type of managerial accounting. It is a system that helps businesses track, analyze, and report financial results and implications. By using project accounting, companies can ensure that they are making the most efficient use of their resources and that all aspects of each project are accounted for. In this blog post, we will discuss what project accounting is and how it can benefit businesses. Let's get started!

Which Type of Businesses use Project Accounting

While project accounting was traditionally used for large construction, engineering, and government projects, it has now expanded into several other sectors including IT, non-profit organizations, and marketing. Project accounting is a specialized form of accounting that keeps track of the financial progress of projects.

What Do Project Accountants Do?

1.Monitor the progress of projects

2. Look into variances

3. Approve outgoing inclusive of expenses.

4. Ensuring that project billings are issued to clients and payments collected.

Could Your Business Use a Project Accountant?

Project accounting is most commonly used in businesses that work based on contracts for unique projects, such as construction companies or advertising firms. Project accounting allows businesses to track revenue and expenses by project, in order to better understand the financial outcome of each project and make more informed decisions about where to allocate resources in the future.

Are you a construction company that is looking for a better way to track job costs? Or an agency that wants to improve the transparency of project billing? If so, then project accounting is definitely for you. Contact me today if you need any advice on where you need to go and what you should be doing to cost your projects properly.

As always thank you for taking the time to read my blog.

If you have any questions, please don’t hesitate to reach out.

Sincerely,

Rebecca C Penner CPA, CGA

Bookkeeping: Month End and Year End Preparation

Every business owner knows that preparing month end and year end financials is important, but not everyone knows how to do it themselves. That's where bookkeeping comes in.

If you don’t have a bookkeeper, the below tasks can seem daunting and time consuming. It doesn’t have to be, you could hire out the service to a bookkeeping company like mine. This way you know your books will be taken care of and you will have one less thing to worry about.

Below are a few key items that need your attention each and every month. If you don’t have the time or you just don’t know where to start, please reach out. Leaving this very important part of your business until later really won’t cut it.

Contact us today for a free consultation: https://rcpenner.com/contact

Contact us today for a free consultation: https://rcpenner.com/contact

Here are a few key tips to help you get organized

Month End Preparations:

• Start by reconciling your bank and credit card statements.

• Review your income and expenses for the month

• Compare your actual results to your budget

• Make any necessary adjustments

• Prepare your financial statements

Year End Preparations

• Record all Transactions

• Make sure your bank reconciliations are complete.

• Review your Financial Statements

• Check your AR and Invoices

• Check your AP

• Perform an inventory count

For Bookkeeping Services Contact us at: https://rcpenner.com/contact

For Bookkeeping Services Contact us at: https://rcpenner.com/contact

Bookkeeping can be a daunting task, but our team of experts are here to help you every step of the way. We'll make sure your books are in order so you can focus on what you're good at - running your business.

Not only will we take care of all your bookkeeping needs, but we'll also provide you with insightful monthly and yearly reports so you can track your progress and see where your business is headed. Let us help you take control of your finances and achieve success.

Contact us today at https://rcpenner.com/contact , and will have you set up and running in no time.

As always thank you for taking the time to read my blog.

I truly hope it has helped.

Sincerely,

Rebecca C Penner CPA, CGA

4 Ways to Improve Your Cashflow Management

Cash flow is the lifeblood of any business, large or small. Without a steady inflow of cash, it can be difficult to meet payroll, pay suppliers, and keep the lights on. That's why effective cash flow management is so important. Cash flow can be managed in a number of ways, but one of the most effective is through careful accounting. By tracking inflows and outflows of cash, businesses can get a better handle on their overall financial health. This information can then be used to make informed decisions about where to allocate resources. With careful planning and execution, businesses can ensure that they always have the cash on hand to meet their obligations.

Contact Rebecca at https://rcpenner.com/contact

Managing your cash flow can be difficult, but it's crucial to keep track of your income and expenses so you can identify trends, especially when your business depends on it. If you're having trouble staying on top of your spending, make a budget and stick to it. Or contact a professional like me. As an experienced cashflow management professional, I am able to help find leaks and show you how to create a way to manage your day-to-day finances properly.

The 4 ways we can Improve your Cashflow Management are as follows:

1. Understand your cash flow - track your income and expenses so you can identify trends.

2. Make a budget and stick to it - this will help you stay on top of your spending

3. *Delay payments where possible - if you can, pay bills and other expenses in installments rather than all at once. *note that only apply this method if you won’t be charged interest, or if you are that it is not a high interest rate. (Do not delay payments for credit cards).

4. Invest in a good, reputable Accountant to help you manage your finances more effectively.

Improving your cashflow management can help you keep your business running smoothly. In order to be successful, business owners need to have a firm understanding of their cashflow. This includes knowing when money is coming in and going out, as well as how much money they have on hand. Improving your cashflow management can help you stay in control of your finances and make sure your company is always operating optimally.

And lastly, don't be afraid to ask for help when needed - there's no shame in admitting that you don't know how to do something and seeking guidance from someone who does. Need help managing your finances? Contact me today. I'd be happy to assist you! https://rcpenner.com/contact

As always thank you for taking the time to read my blog. I truly hope it has helped.

Sincerely,

Rebecca C Penner CPA, CGA

The Difference Between Budgets and Forecast

Do you own a business? If you answered yes, then this is an article you don’t want to miss. Business owners more often than not have little knowledge of where their company is in regard to their financial health. Meaning they have no idea if the company is doing well or not and if not what they will have to do to improve. This is where an accountant like me can help, with budgets and forecasts.

Contact me for a FREE consultation:https://rcpenner.com/contact

Budgets and forecasts are similar financial tools that accountants use to establish plans for a company’s future. These tools enable us to see what is happening now versus what can/will happen in the future, whether your company is in a good financial state or not. Then once this information has been gathered a plan of action is put in place.

Do you know if your company is meeting your financial goals? If not, I can help you find this information. So, let’s look at the differences between a budget and a forecast and why you need to do both.

1. A budget reveals the shape a company is in financially within the span of a year.

2. A forecast uses past historical data to predict a company’s future financial outcomes.

The purpose of a company having a budget and forecast is to help strategize and plan for the future and align the company goals across the organization.

Both budgeting and forecasting are very important components of every company’s growth. This is needed especially during periods of change within a company. Click the link for access to a free excel budgeting spreadsheet: https://best-excel-tutorial.com/59-tips-and-tricks/248-company-budget

Below are 2 main reasons a budget is important:

1. Budgeting is an important tool for decision making

2. A great way to monitor business performance

2 main reasons forecasting is valuable to businesses:

1. A forecast is able to help you make informed decisions.

2. With these decisions you can then develop a strategy.

When you first open your business, it is vitally important that you know what your financial situation is. Hiring someone with the skill and expertise in finance is extremely important, especially if you don’t know anything about budgeting and aren’t able to forecast where the company will go in the future. This is when you will definitely need a professional in your corner to help guide you.

As always thank you for taking the time to read my blog. I truly hope it has helped.

Sincerely,

Rebecca C Penner CPA, CGA

Best Payroll Software for Small Businesses

Are you a small business that is looking for an easier way to process your payroll? Or are you looking to change your payroll software program to make this once timely part of your business easier? If you answered yes to any of the above questions, then you are in the right place. Keep reading.

Let’s define what a small business is considered to be in Canada, before we get into the best payroll software. The Treasury Board of Canada Secretariat defines a small business that has fewer than 100 employees or between $30,000 and $5 million in annual gross revenues as a small business.

There are on average around 95,000 new businesses opened in Canada each year. With 98.9% of businesses being small to medium sized. And around 260 new companies are founded in Canada each day.

There are on average around 95,000 new businesses opened in Canada each year. With 98.9% of businesses being small to medium sized. And around 260 new companies are founded in Canada each day.

For each and every business, if and when they acquire employees a payroll software will be required.

The listed payroll systems below are the ones to look into, and are said to be the most popular systems that are being used to date in Canada:

• Payworks – This payroll software program has HR and payroll functions to help you get your payroll out on time every time. The added bonus for this system is their user-friendly platform and customer service.

• WagePoint – Their small business payroll software makes it easy to pay your employees and stay on top of your payroll taxes. This software company is also good if you have sub-contractors on your payroll.

• QuickBooks – If you use QBO for your business or your bookkeeper does then QBO payroll services is quick and easy to integrate.

All the above payroll software companies have their own individual qualities that will help any business owner or bookkeeper with payroll. Research a few of them. Pick up the phone and call the companies and see which one you feel will work for your business. You also have to feel comfortable with whichever payroll company you choose. So, keep that in mind while doing your research.

All the above payroll software companies have their own individual qualities that will help any business owner or bookkeeper with payroll. Research a few of them. Pick up the phone and call the companies and see which one you feel will work for your business. You also have to feel comfortable with whichever payroll company you choose. So, keep that in mind while doing your research.

I hope my blog has been of help and that you have a clearer guide as to which payroll software company to look into. If you have any questions or want to outsource your payroll, please contact me at https://rcpenner.com/bookkeeping

Thank you for taking the time to read my article.

Don’t miss out on future blogs. Sign up to get them directly in your inbox hot off the press each week.

Sincerely

Rebecca C Penner CPA, CGA

4 Ways to Ensure Tax Compliance

To be certain, you are in compliance when dealing with your taxes, the CRA requires you to keep hold of all supporting documentation. This consists of any receipts, documents, and tax forms, for six years from the end of the last tax year to which they relate.

Rebecca C Penner CPA, CGAhttps://rcpenner.com/contact

To help with keeping all your files in order and safe from being accidentally thrown out. It is a good idea to scan your documents and keep them on a separate hard drive. Or to keep all your documents in a cloud-based storage such as Hubdoc. Hubdoc is an online tool that can also help you with your bookkeeping. This will allow you to say goodbye to old shoe boxes full of receipts and hello to 2022 and cloud-based storage. If you’re interested in finding out more about Hubdoc click the link: https://www.hubdoc.com/

What is Canadian Tax compliance?

Canada’s tax system is based on self-assessment. The CRA uses the self- assessment system to collect income tax. This means the tax obligation of a taxpayer is paid during the assessment year before the income tax returns are filed.

For self - assessment to work, society as a whole must fully support it. This ensures fairness to all.

What are the 4 determinants of Ensuring Tax Compliance?

1. Tax Awareness – You may think that this is something that every person should know. But what if you are a recent immigrant to Canada. How do you even know what questions to ask if you don’t understand the tax law? If you are new to Canada please click the link provided here to find out what you need to do:https://www.canada.ca/en/revenue-agency/services/tax/international-non-residents/individuals-leaving-entering-canada-non-residents/newcomers-canada-immigrants.html

2. Tax Fairness – This means that a governments system of taxation must be equitable to all of its citizens.

3. Tax Complexity – Tax professionals relate tax complexity mainly to the ambiguity and excessive changes in tax laws. Also, with the need to comply.

4. Tax Information – Means documentation or information pertaining to your tax status once filed.

Rebecca C Penner CPA, CGAhttps://rcpenner.com/contact

The importance of tax compliance with tax laws is to ensure the system keeps working for all. Tax compliance also ensures the ongoing support of many government programs and services. If all governments keep the tax rules as clear as possible then everyone wins. If a country has a complicated tax system, it is generally associated with high tax evasion. Which in the long run doesn’t help anyone.

As always thank you for taking the time to read my blog.

If you have any questions, please don’t hesitate to reach out.

Sincerely,

Rebecca C Penner CPA, CGA

TFSAS vs RRSPS

RRSPS vs TFSAS what are they and what are the differences that you should be aware of before choosing either one. Which one should you be contributing to each year and why?

A Registered Retirement Savings Plan (RRSP) is a savings plan that is registered with the Canadian Federal Government. It is a savings plan that allows you to contribute for your retirement. An RRSP allows you to defer your taxes until a later date. It is not a Tax-Free account. You will be taxed when you withdraw funds from an RRSP account.

Rebecca C Penner CPA, CGA https://rcpenner.com/contact

A TFSA account is a Tax – Free savings account that you can contribute to and not have to pay tax on the amount that you withdraw. Because of the high tax implications with an RRSP, I wouldn’t recommend contributing to an RRSP 100% of the time. Unless your income is on the higher end.

Let’s take a look at 4 TFSA tips:

1. Planning for your retirement – No matter what age you are, be that in your 20s or 50s, planning for when you retire is an important part of being financially responsible. Determine what kind of lifestyle you want to live in your retirement years and set goals accordingly. Your financial advisor can help you with this.

2. There is a limit amount that you can contribute each year to your TFSA account. The limit for 2021 was $6000. Which is the same for this year 2022.

3. Contributing to your TFSA account as early as possible gives your money more time to benefit from tax-sheltered growth.

4. Unused contribution room can be carried forward to use in future years.

Rebecca C Penner CPA, CGAhttps://rcpenner.com/contact

Rebecca C Penner CPA, CGAhttps://rcpenner.com/contact

How can you make your TFSA account successful? In general, you should aim to contribute to your TFSA each year. Ideally if you can start contributing in your early 20s you could end up with a very comfortable retirement later on.

When you’re in your 50s a good gauge for assessing your retirement, readiness is to have saved seven times your annual income by the age of 55. So, the earlier you start your investment journey the earlier you will be able to retire and enjoy your life on your terms.

A good place to start if you are in need of financial advice is to contact a financial advisor. Your accountant would be able to help you with this and point you in the right direction.

Thank you for taking the time to read my article.

Don’t miss out on future blogs. Sign up to get them directly to your email inbox hot off the press.

Sincerely

Rebecca C Penner CPA, CGA

GST When Do You Need to Register

What is GST and who and when do you need to pay it as a small business owner? GST, or Goods and Services tax is a sales tax that is charged on almost all goods and services that are sold in Canada.

The current 2022 GST rate in Canada is 5%. You will see this 5% amount added to your bills. If you are a small business owner depending what your earnings are, you should be extracting this 5% GST from each receipt that you have paid and then remitting your GST to the CRA every quarter or annually.

Book Your FREE Consultation https://rcpenner.com/bookkeeping

Book Your FREE Consultation https://rcpenner.com/bookkeeping

Let me explain in more detail what it is you need to do and when.

During the pandemic we saw many small businesses opening. People were not necessarily quitting their jobs (although some did). They were opening what is called a side hustle.

Most of these businesses were earning very little at first, which is normal when a business is first opened. So, there was no need to add to their invoices the 5% GST amount.

But as some of the businesses grew then GST was something most people had questions about. The most popular questions were, “how much does my company need to be making to be able to add GST onto the invoices for our customers”. And “how do we get a GST number to be able to remit GST”.

To be required to charge GST and remit the GST to the CRA comes down to just two factors:

1. The type of supply you are selling.

2. The number of sales you have.

Not all businesses are required to charge GST. As well as not all services are subject to GST. The following link to the CRA website will allow you to calculate if you are required to charge and remit GST.

When and how do you remit your GST? See the points below and a link to help you from the CRA.

When and how do you remit your GST? See the points below and a link to help you from the CRA.

• If your business is no longer classed as a “small business”. This means your sales exceeded $30,000 or more in a single calendar quarter (3 consecutive months).

• $30,000 within four consecutive calendar quarters. Do not mistake this for a calendar year.

• If your business is at the above amount you are required to register for a GST number. This will allow you to begin to charge, collect and remit your GST tax.

This is where you will need proper record keeping. A bookkeeper will make sure that your GST is recorded from every transaction and that you remit your GST on time every time.

If you don’t have the time to keep track of this yourself then you are in need of a bookkeeper. Please contact me for any questions that you may have about my bookkeeping services. I can help keep you on top of your finances and in good standing with the CRA.

This is not one of those things you can keep putting off. So, if you don’t have the time or the know how then contact me.

As always thank you for taking the time to read my blog.

If you have any questions, please don’t hesitate to reach out.

Sincerely,

Rebecca C Penner CPA, CGA

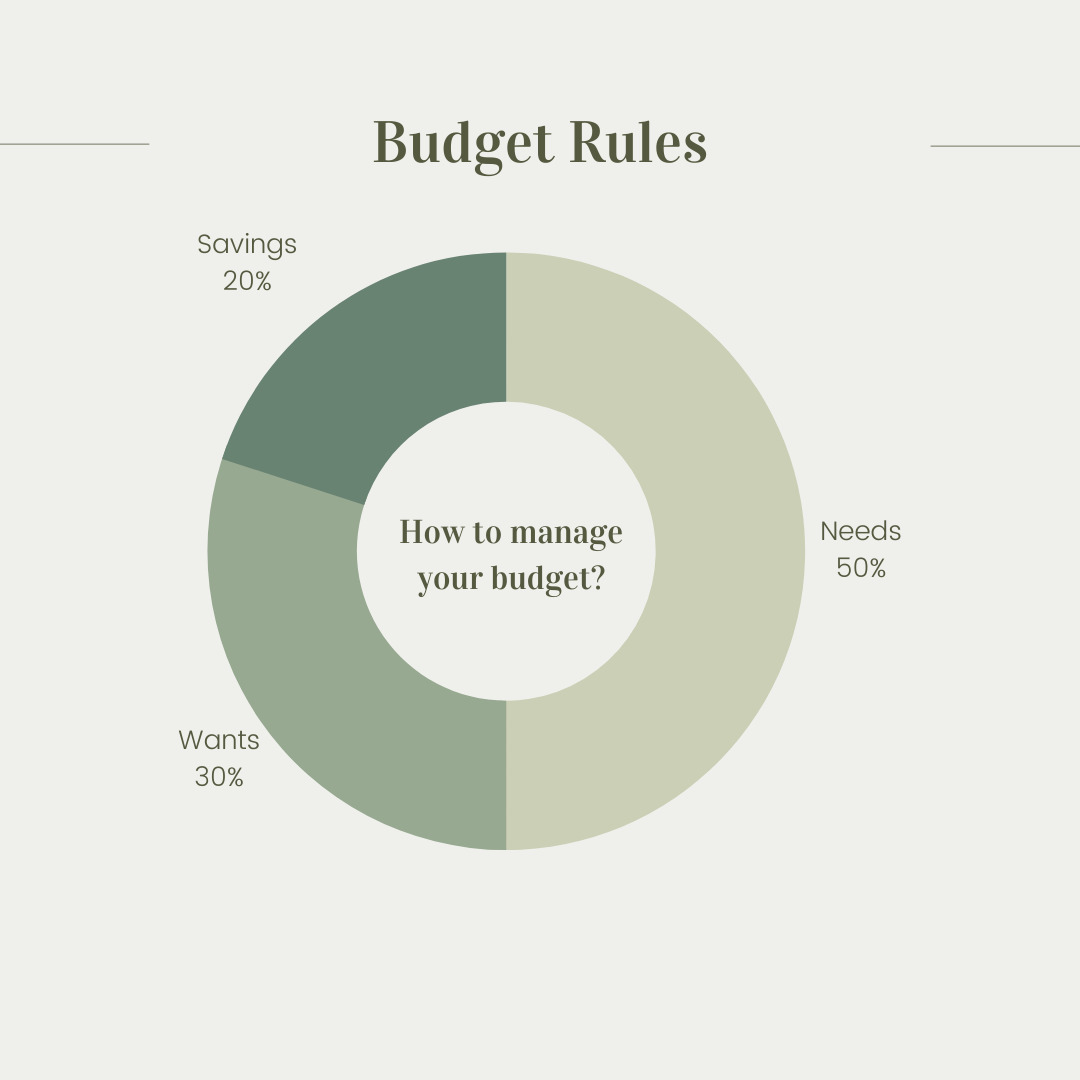

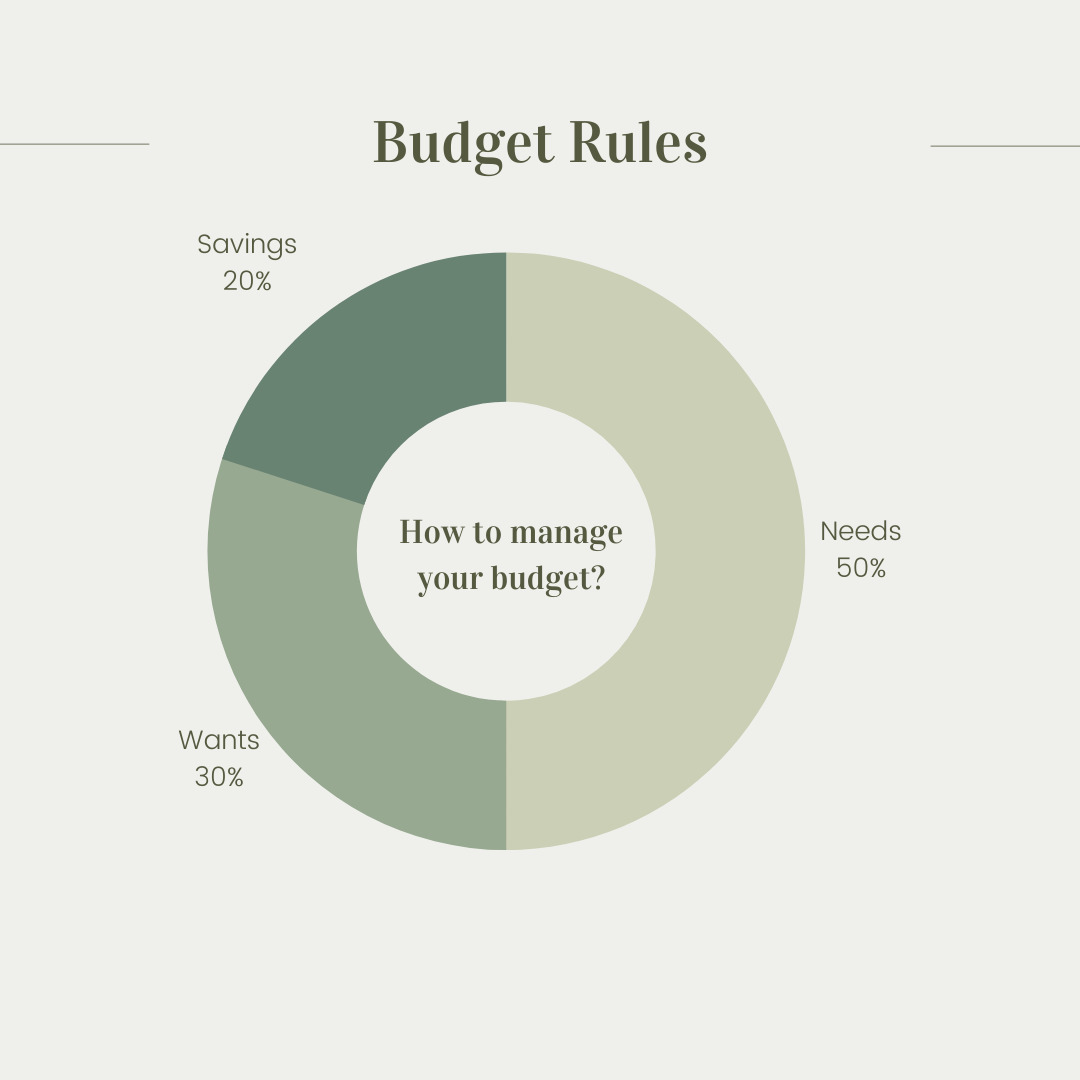

Creating a Sustainable Budget 101

What is a budget and why should everyone have one in place? And how can you come up with a plan for a budget that is sustainable over the time period you need one for.

Let’s start with the question what a budget is. A budget is a management tool that anyone can use and implement either for a short or long time period. Say you want to save for a down payment on a mortgage. Then short-term budgeting will help you get to your goal amount. Or long-term budgeting for things such as your retirement.

Rebecca C Penner CPA, CGA https://rcpenner.com/contact

The following steps will help you create and maintain a sustainable budget.

1. The first step is to know your net income each month. You will need to sit down and identify the amount of income that you have coming in each month.

2. Create a spread sheet to track your monthly spending. For things like rent/mortgage, utilities, groceries and personal spending. Excel have some great templates to use to track your financial outgoings. This is also great for seeing where your money is being spent. For instance, if I asked you to tell me how much money you spend per month on coffee, most people will say “oh no not that much” until they start tracking each time, they buy a Starbucks or Tim Hortons.

3. Step 3 is to establish and set your financial goals. Why are you doing this in the first place. What is your goal amount? Make sure you are setting yourself up to succeed by setting a realistic and sustainable goal. Like I said before if your goal is short term, then put the date that you need your budget to end. If it’s a long-term goal, then the budget will be set to ongoing.

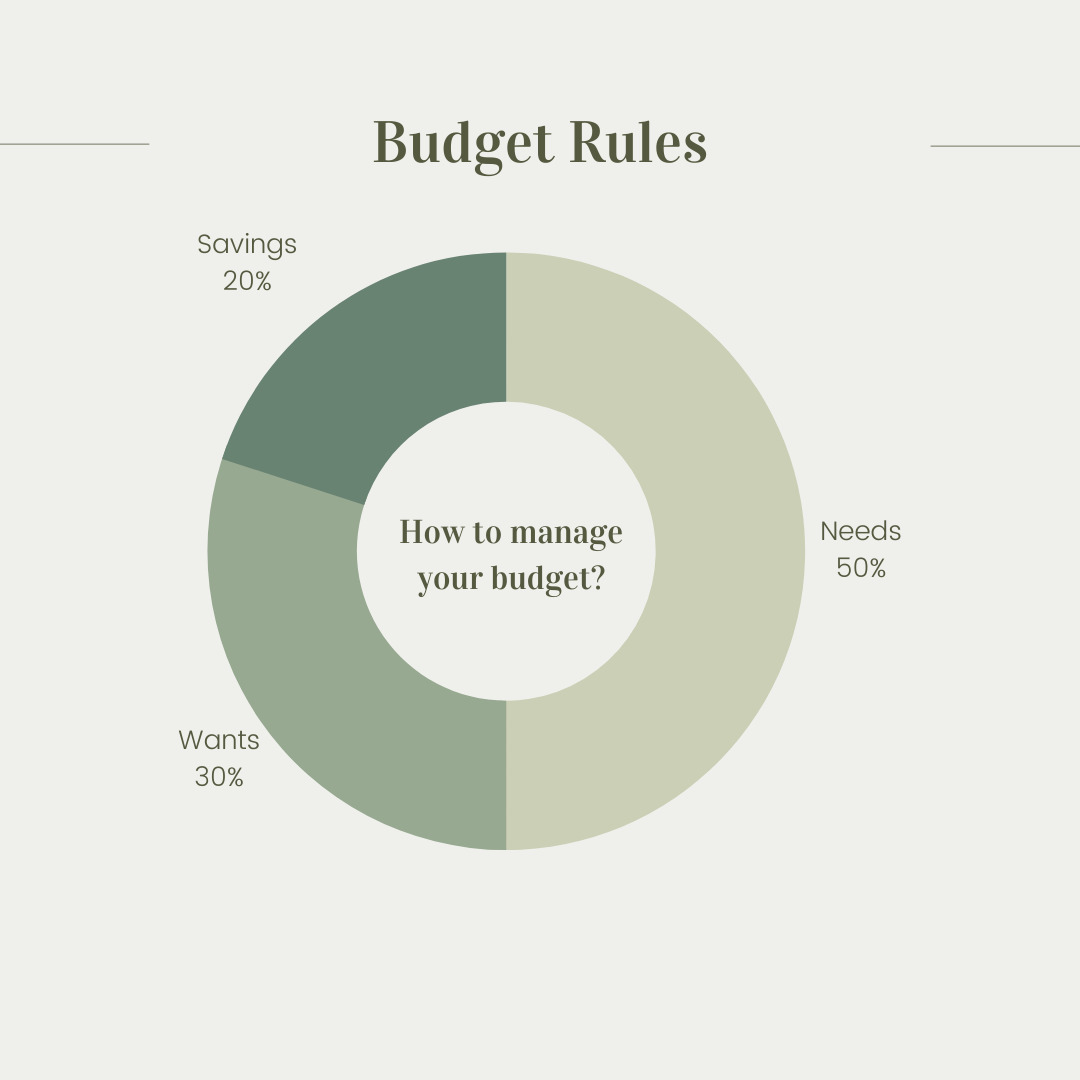

4. As in the picture above you will need to separate “Needs and Wants”. By this I mean to be able to reach your financial goal what do you need to pay out each month, oppose to what is it you want. The rent and utility bill are a need to pay. That Lois Vuitton purse is a want. So, what will you sacrifice to get to your goal?

Rebecca C Penner CPA, CGA https://rcpenner.com/contact

5. Once you have taken care of all the above steps you will need then to put your budget plan into action. Choose a date that you will start your budget and a date when you want to reach your budget goals.

6. Pick a day each week to check in and see where you are. Are you on track? Does your goal need adjusting? Did an unexpected purchase occur, and because of this you may need to reassess your goal end date?

To move forward with our lives and not struggle each month to pay our bills, we all should establish a budget. Everyone should know how much each month you will need just to live. This isn’t the amount spent on going to a restaurant or buying personal items. You will need a budget for these things also.

Living above our means is a very easy thing to do in our time. We are bombarded with credit card advertising and loans that are readily available to us. We can all get sucked into the fantasy of paying a large interest rate for the life we want to live but really can’t afford.

Financial assistance is readily available to advise you in your financial journey.

Thank you for reading my blog and if you need any assistance with finances please contact me.

As always thank you for taking the time to read my blog.

If you have any questions, please don’t hesitate to reach out.

Sincerely,

Rebecca C Penner CPA, CGA

Is Accounting Only for Big Businesses?

Is Accounting only for big businesses? Well, the answer to that is an emphatic and resounding NO. Accounting plays an essential role of running a business. No matter how big or small that business is. An Accountant is the go-to person if you as a business owner needs information about any part of your business’s finances.

Your accountant can tell you in an instance whether your company is making a profit or loss and will know how “healthy” your businesses finances are. Accounting plays a vital role in every business. If you own a business and are in need of an accountant just call the number below.

Contact Rebecca C Penner Today at 403-966-2814

Even if you have a bookkeeper you might still wonder do I need an accountant too. Again, the short answer to that question is a resounding YES. Bookkeepers are not accountants no matter what some may tell you. There are certain things a bookkeeper can and can’t do.

As you can see on my website, I do offer bookkeeping services as well as accounting services. I am able to offer these services with confidence as a Chartered Professional Accountant (CPA). Which means I can also provide financial planning. I will explain what all this means below:

Bookkeeping

Usually, the bookkeeping part of any business is overseen by an accountant. Accountants use the information provided by the bookkeeper to prepare financial reports and statements. So bookkeeping is essentially one segment of the whole accounting system. The accountant will start where the bookkeeper ends.

Financial Planning

Financial planning as an accountant means that we can help discover areas within your business that need attention and potential risks you may face within your business. We can also offer feedback on your current business incomings and outgoings. We are not financial advisors in the sense where we can help you with your investments. But as a Chartered Professional Accountant (CPA) we can help with the financial decisions within your company.

So, going back to our original question. Is Accounting only for big businesses and what role does an accountant play in your company.

The primary task of an accountant is to prepare and examine financial records. We make sure that records are accurate and that taxes are paid properly and on time, (refer to my blog on taxes click the link here). Accountants and auditors (which accountants can also perform), perform overviews of the financial operations of a business in order to help it run efficiently.

Finding a professional that can take the worry off your hands and have the confidence in knowing that your company is taken care of is an important part of running a business.

Please contact me for a FREE initial consultation at 403-966-2814

As always thank you for taking the time to read my blog.

If you have any uestions, please don’t hesitate to reach out.

Sincerely,

Rebecca C Penner CPA, CGA